A lot of people think that Quantative Easing leads to or would lead to high inflation.

Let’s examine the facts.

A huge amount of QE took place after the 2008 crash, in the U.S. , the U. K. and Japan.

After COVID there was more QE. The numbers are mind boggling.

How QE works

https://www.bankofengland.co.uk/monetary-policy/quantitative-easing

The Federal Reserve's balance sheet ballooned following their March 15, 2020 announcement to carry out quantitative easing to increase the liquidity of U.S. banks. It reached 8.36 trillion U.S. dollars as of September 7, 2021. This measure was taken to increase the money supply and stimulate economic growth in the wake of the damage caused by the COVID-19 pandemic.

https://www.statista.com/statistics/1121416/quantitative-easing-fed-balance-sheet-coronavirus/

“So what we're saying here is that we took a $3.7 trillion gamble to save our financial systems, and you know what, it paid off. There was no inflation.”

https://www.ted.com/talks/michael_metcalfe_we_need_money_for_aid_so_let_s_print_it

To understand what has happened we have to know who prints money.

Here’s a great article from Martin Wolf in the Financial Times from 2014.

https://www.ft.com/content/46a1ce84-bf2a-11e3-a4af-00144feabdc0

“Fifth, the authorities can also affect the lending decisions of banks by regulatory means – capital requirements, liquidity requirements, funding rules and so forth. The justification for such regulation is that bank lending creates spillovers or “externalities”. Thus, if many banks lend against the same activity – property purchase, for example – they will raise demand, prices and activity, so justifying yet more lending. Such a cycle might lead – indeed often has led – to a market crash, a financial crisis and a deep recession. The justification for systemic regulation is that it will, or at least should, attenuate these risks.

Sixth, banks do not lend out their reserves, nor do they need to. They do not because non-banks cannot hold accounts at the central bank. They need not because they can create loans on their own. Moreover, banks cannot reduce their aggregate reserves. The central bank can do so by selling assets. The public can do so by shifting from deposits into cash, the only form of central bank money the public is able to hold.”

Also, in this article, he explains how private banks, not governments, create money.

“I explained how this works two weeks ago. Banks create deposits as a byproduct of their lending. In the UK, such deposits make up about 97 per cent of the money supply.

Printing counterfeit banknotes is illegal, but creating private money is not. The interdependence between the state and the businesses that can do this is the source of much of the instability of our economies. It could – and should – be terminated.

I explained how this works two weeks ago. Banks create deposits as a byproduct of their lending. In the UK, such deposits make up about 97 per cent of the money supply. Some people object that deposits are not money but only transferable private debts. Yet the public views the banks’ imitation money as electronic cash: a safe source of purchasing power.”

https://www.ft.com/content/7f000b18-ca44-11e3-bb92-00144feabdc0

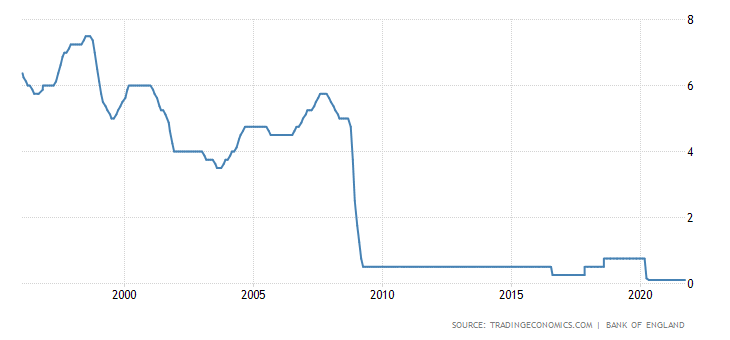

Interest rates

https://tradingeconomics.com/united-kingdom/interest-rate

for EU and the USA https://www.bruegel.org/wp-content/uploads/2021/03/PC-07-2021.pdf

Further reading

https://positivemoney.org/what-we-do/magic-money-tree/

https://positivemoney.org/how-money-works/banking-101-video-course/#banking101part3

https://positivemoney.org/2012/10/listen-to-bbc-radio-4-how-banks-create-money/

https://positivemoney.org/2014/08/7-10-mps-dont-know-creates-money-uk/